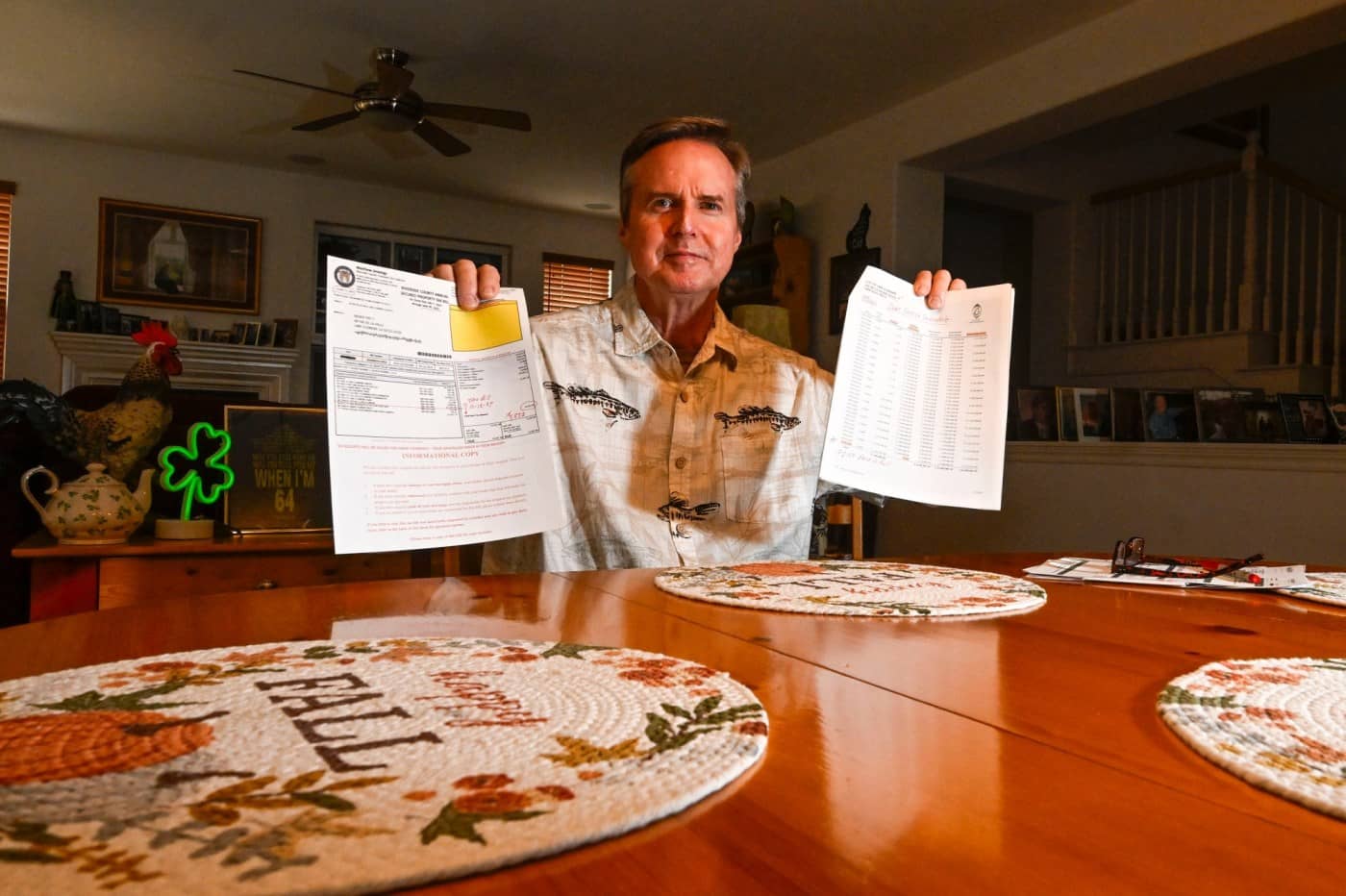

Hundreds of Lake Elsinore residents have a sharp-eyed former city administrator to thank for taking a close look at his latest county property tax bill.

Pat Kilroy, who worked for the city for 20 years and retired in 2014 as its lake, parks and recreation director, says he was quickly drawn to a line item on his Riverside County tax bill marked “CFD 90-2 Lake Elsinore.”

Kilroy recognized the charge as a recurring Mello-Roos tax that Kilroy and other Tuscany Hills residents had been paying since 2007 to cover $7.3 million in bond debt for infrastructure improvements in their neighborhood.

Kilroy reviewed the city’s annual report for Tuscany Hills and noticed that the special levy, called a Community Facilities District tax, had matured on Oct. 1, was paid off and showed a principal outstanding balance of zero.

“I’m a retired administrator from this city. I knew this bond was maturing and I was looking forward to NOT paying $2,000 every year,” said Kilroy, 66.

Kilroy said he contacted the city clerk and Councilman Timothy Sheridan on Nov. 8, but it took the city nearly two weeks to give Kilroy a firm answer: The city had, in fact, erred, and corrective measures were in order for the more than 400 Tuscany Hills residents whose property tax bills showed they still owed the tax.

While Kilroy claims the city dragged its feet, Sheridan said in an email it only took eight business days to rectify the situation once officials were made aware of the problem.

“While we never want to see issues like this arise, we worked diligently and quickly to address the issue,” said Sheridan, noting city officials had to work with a private company that functions as the city’s tax administrator as well as the county in resolving the matter.

Sheridan said that of 424 Tuscany Hills residents affected by the mistake, four had already paid their bills. They will be refunded, he said, as will more should that become necessary.

“There are a number of homeowners who will be receiving revised tax bills and refunds if the homeowners in question have already paid the tax bill,” Sheridan said of the CFD tax, which varied according to the square footage of each house but averaged more than $2,000 annually.

Kilroy said he is even more perplexed that the City Council, on June 25, approved a $885,115.10 levy for Tuscany Hills residents and adopted a resolution requesting the Riverside County tax collector to place special taxes on Tuscany Hills residents through June 30, 2025, clearly unaware the tax debt was only a few months from being paid off.

“The budget exhibit is just laughable because it’s just so precise. They calculated it down to 10 cents, and it’s as wrong as can be,” Kilroy said. “Who calculated this figure?”

City Manager Jason Simpson said the city and its consultants made an error in enrolling special taxes for the Community Facilities District it created for the Tuscany Hills neighborhood, which was built in the early 1990s northeast of Lake Elsinore and southwest of Quail Valley.

Cities and counties, under the Mello-Roos Community Facilities Act of 1982, can establish CFDs as a mechanism to finance public works project and services.

“While the bond maturity was documented, this critical information was not fully reconciled during the tax levy process at the time of Council approval,” Simpson said in an email. “The June 25, 2024, staff report and resolution approving the special tax levy were based on data available earlier in the year, prior to the bond maturity date. This was an administrative oversight during the reconciliation process.”

Sheridan said the City Council does not need to take any formal action to rescind and revoke its June resolution. “Equally importantly, it is important to recognize that the resolution did not create a new tax,” he said. “It was considered and passed to meet county requirements only.”

Simpson said the city is reviewing its internal procedures and implementing new protocols to prevent future oversights.

Kilroy said his confidence in the city is now shaken.

“My point of view is that the City Council is entirely blameless. They have highly paid professional staff who have expertise in finances, and they brought forward what appears to be false information,” Kilroy said. “To me, this was not a mere mistake. This is just negligence.

“How could you write a staff report and not have that annual report right next to you as an exhibit? I’m just dumbfounded.”